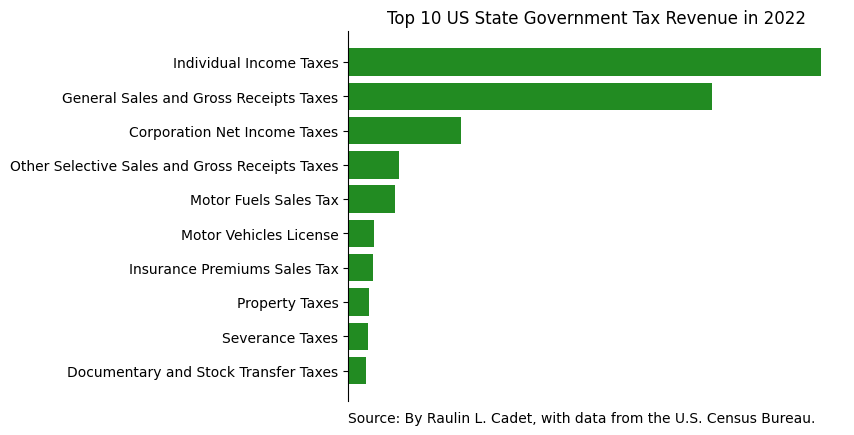

Top 10 US State Tax Revenues: 2022 Insights

By Raulin Cadet | Published Nov. 20, 2023 | Updated Nov. 21, 2023 | Topics: USA, Tax, State government

Tax is an important source of revenue for the government, in any economy. The government has the authority to determine tax that individuals an the corporations should pay. In USA, in addtion to the Federal taxes, individuals and corporations have to pay state taxes.

Concept: Tax rate is the percentage at which an individual or a corporation should pay tax, based on his/its revenue or sales or property.

The graphic of this article shows that individual income taxes are at the top position whereas general sales and gross receipt taxes are in the second position, followed by Corporation net income taxes. Since some U.S. states use progressive income tax system, this may induce higher individual income taxes. As explained by Don Hofstrand, people with a higher income pay more because of their higher earnings, but they also face a higher tax rate. Since the population is relatively large, with low unemployment rate, it is understable why general sales and groos receipt taxes is the second tax revenue source of the states. Indeed sales tax may be high, since the population consumption is high in a country with a culture of consumption and debt (see this history of consumer culture in USA).

The United States' consumption culture may raise sales taxes and even corporation net income tax in addition to stimulating economic activity. In fact, greater sales may result in greater profits, encourage the creation of new enterprises, and lead to increased tax contributions.