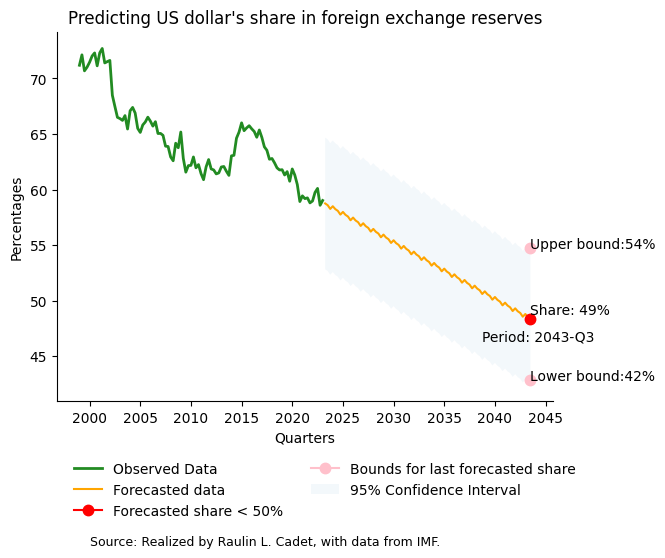

Predicting US Dollar's Reserve Share

By Raulin Cadet | Published Sept. 27, 2023 | Updated Sept. 27, 2023 | Topics: USA, Exchange reserves, Currency, US dollar, Forecasting

In the world of global finance, understanding the US dollar's share in foreign exchange reserves is crucial. My question is: when could this share fall below 50%? Investors and financial markets closely watch this number, knowing that if the dollar's influence declines, it could change markets, investment plans, and how much assets are worth.

Concept: Foreign exchange reserves are like a country's savings kept in other countries' money. It's similar to saving money in a bank, but in many different kinds of money, managed by a country's central bank.

If fewer people and banks around the world want US dollars because it's less of the reserve money, then the dollar's worth drops. That's because countries and investors aren't buying as many US dollars.

To figure out when the US dollar's portion will drop, we use past data and a simple model to forecast future data: Holt-Winters. Assuming other factors do not change, forecasted data show that the US dollar's share could go below 50% by the third quarter of 2043, reaching 49%. But, because things can change, we also estimate at a range of that share which is between 42% and 54% at the mentioned period.

This prediction highlight how money value changes around the world.